Helium Market Outlook: A Transformative Decade Ahead

The global helium market is on a steady upward trajectory, with projections suggesting it will nearly double from USD 4.4 billion in 2025 to USD 8.5 billion by 2035. In this opinion editorial, we take a closer look at the factors driving this growth, the tricky parts of its supply chain, and the key applications that are fueling demand across various sectors—from healthcare to semiconductor manufacturing and aerospace. In doing so, we also explore regional perspectives and offer insights into ways governments and industry players can figure a path toward a more resilient supply chain.

The information presented here is not merely about raw numbers and forecasts. Instead, it offers a comprehensive exploration of the helium market’s evolution, considering the fine points of its applications, the tangled issues facing its supply logistics, and the subtle distinctions among the various helium grades that organizations must manage.

Demand Drivers and Key Applications

One of the primary engines behind the helium market’s growth is the increasing need for ultra-high purity gases across critical applications. Medical imaging techniques, such as MRI, depend on helium for the cooling of superconducting magnets. Meanwhile, the semiconductor industry requires extremely pure helium to ensure quality during chip miniaturization and advanced electronics production. Aerospace and defense sectors also increasingly depend on helium for pressurization and cryogenic cooling needs.

Innovative Helium Cooling in Medical Imaging

Medical equipment, especially MRI machines, rely on super-cooled helium to function effectively. The cooling process is essential for achieving the near-absolute-zero temperatures required by superconducting magnets. With healthcare advancements pushing technological boundaries, the adoption rate of these systems has surged, thereby fueling helium demand. Key trends include:

- Increasing number of diagnostic imaging centers in developed countries and emerging markets.

- Advances in helium recovery and recycling systems designed to reduce operational costs and supply issues.

- Strategic partnerships between helium suppliers and medical equipment manufacturers.

These factors ensure that helium remains an essential resource in the medical imaging field and underline the broader importance of sustaining a reliable helium supply.

Advanced Semiconductor Manufacturing and Electronics Applications

The semiconductor market is witnessing a transformative period with innovations in chip design and fabrication. The need for ultra-high purity helium in the semiconductor production chain is critical. Semiconductor-grade helium contributes to the creation of controlled environments necessary for fabricating complex electronic components.

Semiconductor manufacturers are pushing for stricter contamination controls, and the fine points of using high-purity helium have become a key competitive differentiator. The demand here is characterized by:

- Adoption of helium in advanced chip manufacturing processes.

- Expansion of semiconductor fabrication facilities in strategic regions.

- Innovations in helium purification and liquefaction technology.

Helium’s Role in Aerospace and Defense

Helium’s importance extends well beyond clinical and semiconductor uses. In the aerospace and defense sectors, helium provides indispensable cooling and pressurization support for rocket propulsion systems, satellite cooling, and even surveillance systems. Its unique inert properties and low boiling point make it a must-have in advanced cryogenic applications, where even slight differences in temperature management can have significant consequences.

Key observations include:

- Robust demand from emerging aerospace industrial hubs.

- Integration of helium in satellite launch and recovery operations.

- Technological advances in helium recovery practices that help to address supply chain issues.

Understanding the Market’s Supply Side: Tricky Parts and Confusing Bits

While robust demand is one side of the coin, the helium market supply does face several tricky parts. Extraction from natural gas reserves requires extensive purification processes, and the inherent challenges associated with cryogenic storage and liquid handling add layered complexity to the overall supply chain.

Several issues make the supply chain for helium particularly nerve-racking for smaller industrial players, including:

- Limited geographical regions where helium extraction can take place.

- High energy consumption during cryogenic liquefaction processes.

- Export and regulatory restrictions imposed by helium-producing nations.

This complex landscape forces many organizations to take a closer look at mitigating the supply risks by diversifying sourcing strategies and investing in advanced recovery and conservation systems.

Challenges in Helium Extraction and Liquefaction

One significant challenge in helium production is the extraction process itself. Helium is usually extracted from natural gas reserves, where it exists in low concentrations, making the purification process both energy-intensive and costly. The following points highlight the main hurdles:

- Energy-intensive cryogenic processes that result in relatively high production costs.

- Tangled issues related to the sustainability of extraction methods amid tightening environmental guidelines.

- Limited local infrastructure in developing regions, which can be intimidating for smaller operators trying to get around complex storage requirements.

Supply Security and Geopolitical Tensions

Even as demand increases, supply-side constraints remain a major concern. Geopolitical factors and export restrictions in some helium-producing countries add twists and turns to the process of securing a stable supply. As a result, many end-users are forced to figure a path through diverse sourcing strategies, considering factors such as:

- Domestic production capabilities versus international sourcing.

- Diversification of supply channels to mitigate potential export bans or trade restrictions.

- Implementation of advanced helium conservation practices to reduce overall consumption in critical applications.

This tense environment demands that government initiatives and industry partnerships work closely to ensure supply continuity amid a market that is both promising and loaded with challenges.

Regional Perspectives: The U.S., China, and Beyond

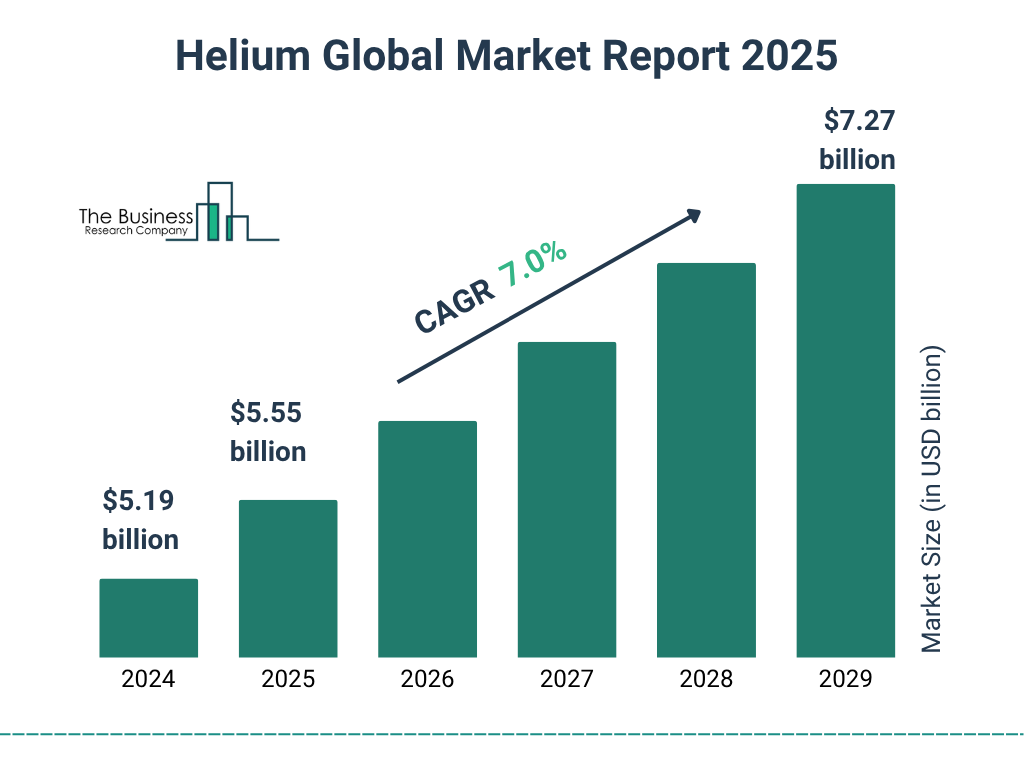

The helium market is not uniform across all regions, and the growth patterns reveal some interesting differences. While the overall CAGR of 6.8% paints a broad picture, regional dynamics add unique flavors to this growth story.

United States: A Leader in Helium Innovation

The U.S. emerges as a frontrunner in the helium market with a forecasted CAGR of 7.4% through 2035. This leadership position is bolstered by domestic production from facilities like the Federal Helium Reserve, advanced healthcare infrastructure, and expanded semiconductor manufacturing. Regions such as Houston, Los Angeles, Silicon Valley, and Boston are hotspots where helium is integral for both high-tech and industrial applications.

Key advantages in the U.S. market include:

- Robust research and development that supports new helium recovery technologies.

- Well-established industrial gas networks and logistical capabilities that make distribution less intimidating.

- Strategic government and private sector partnerships that work through supply chain difficulties.

China: Accelerating Industrial and Medical Advancements

China’s rapid industrial change has also had a significant impact on helium consumption. With a projected CAGR of 7.1%, China is witnessing an accelerated expansion of semiconductor fabrication facilities and medical imaging centers in cities like Beijing, Shanghai, Shenzhen, and Guangzhou. Government initiatives aimed at bolstering the domestic electronics industry play a critical role in this region’s helium consumption.

Factors contributing to China’s helium market growth include:

- Expanding semiconductor production fueled by government incentives.

- A sharp increase in healthcare infrastructure investments to meet growing demand.

- Strategic collaborations between international helium suppliers and local industries to manage supply chain challenges.

India, Germany, and Other Key Markets

India is poised to register a growth rate of around 7.0%, primarily driven by expanding medical imaging capabilities and a burgeoning electronics manufacturing sector. Meanwhile, Germany’s strong industrial base and advanced manufacturing networks position it as a stable market, anticipated to grow at 6.6% through 2035. Japan and South Korea also contribute to the dynamic global landscape, each with growth rates exceeding 6.0% in their respective sectors.

Some concise takeaways for these critical regions include:

- India: Emphasis on healthcare infrastructure and emerging semiconductor fabrication centers.

- Germany: Integration with precision industrial applications and robust supply networks.

- Japan and South Korea: Ongoing development in electronic manufacturing and medical technology sectors.

Market Dynamics: Fine Points and Subtle Differences in Helium Grades

The helium market is segmented not only by its applications but also by the phase in which the gas is utilized. The gas segment currently captures around 72.2% of the market share, making it the dominant phase used in various industrial applications. This segment further breaks down into industrial-grade, ultra-high purity, and semiconductor-grade helium, each notable for specific operational needs.

Gas Versus Liquid Helium: A Comparative Analysis

While the gas phase dominates due to its versatility in applications such as leak detection, welding, and semiconductor processing, the liquid phase also maintains a significant stake—particularly in medical and aerospace applications. The table below summarizes key points associated with each phase:

| Phase | Key Applications | Market Share | Main Advantages |

|---|---|---|---|

| Gas | Semiconductor processing, leak detection, welding | 72.2% | Versatility, cost-effectiveness, high-purity options available |

| Liquid | MRI cooling, aerospace pressurization | 27.8% | Essential for cryogenic applications, specialized grades available |

This comparison illustrates the slight differences and fine shades in performance and application between the gas and liquid forms of helium. Organizations must always take a closer look at these details to decide which phase best meets their operational needs.

Assessing Application Segments: Cryogenics, Leak Detection, and Welding

The helium market is also divided by application type. At present, cryogenics leads with about 23.0% market share, mainly because of its critical role in cooling medical imaging devices and advanced research systems.

Breaking down the application areas further:

- Cryogenics: Vital for MRI machines, quantum computing research, and aerospace scientific missions. This segment leverages helium’s unique cooling properties that are particularly important for superconducting devices.

- Leak Detection: Helium is used in high-sensitivity mass spectrometry systems for ensuring pipeline and equipment integrity—a significant factor in quality assurance and industrial safety.

- Welding: Helium provides an inert atmosphere that helps maintain weld quality in precision metal fabrication processes, particularly in the automotive and aerospace sectors.

Strategic Considerations: Securing Helium Supply and Managing Risks

Although the helium market enjoys a promising outlook, it is laden with several challenges that require strategic planning and robust management efforts. The following sections break down the key areas where strategic interventions are critical.

Advanced Helium Recovery and Recycling Methods

One of the most promising approaches to alleviate supply concerns is the adoption of advanced helium recovery and recycling systems. These systems are designed to capture helium during industrial processes that would otherwise be lost and recycle it for further use. Some of the advantages include:

- Reduction in overall helium consumption.

- Lowered extraction and purification costs.

- Enhanced sustainability and supply security, especially for smaller operations struggling to get around the confusing bits of supply chain management.

Innovative recovery methods offer a super important competitive edge that not only ensures a steady supply but also promotes cost optimization for end-users—an aspect that is especially critical amid rising market volatility.

Government Policies and Regulatory Interventions

The role of government in stabilizing the helium market cannot be overstated. Policy makers are expected to work on streamlining approval processes for new extraction and purification facilities, as well as offering tax incentives for companies that invest in helium conservation technology. Some suggested policy measures include:

- Strategic Reserve Management: Government-backed initiatives to support domestic helium extraction and conservation, helping companies find their way through volatile international markets.

- Tax Incentives and R&D Support: Accelerated depreciation schedules and tax credits to encourage investments in advanced recovery systems, ensuring that the development of new technologies is not intimidating or overwhelming for smaller firms.

- Clear Regulatory Frameworks: Creating transparent standards for helium purity and safety, which help reduce the overwhelming regulatory twists and turns that companies face.

Industry Collaboration and Standards Development

Collaboration among industry bodies, helium producers, and technology developers is absolutely key to creating a harmonious market ecosystem. Some ways to foster this collaboration include:

- Establishing quality standards and certification programs to ensure consistent helium grades for diverse industrial needs.

- Leading market education initiatives that emphasize the importance of helium conservation and resource sustainability.

- Developing interoperability standards for recovery and recycling equipment, which help companies figure a path through the technical twists and turns of system integration.

Regional Case Study: Europe’s Expanding Helium Market

Looking at Europe, the helium market is expected to double from approximately USD 1.2 billion in 2025 to USD 2.4 billion by 2035 at a CAGR of 7.2%. Countries such as Germany, the United Kingdom, France, and Italy are pivotal to this growth. In these regions, healthcare systems and semiconductor manufacturing operations are major consumption drivers.

For instance, Germany retains its leadership position in Europe with well-established industrial gas infrastructures, advanced healthcare networks, and a strong semiconductor sector. The subtle details of helium usage in these sectors underscore the importance of maintaining high-quality supply chains that can handle the nerve-racking demands of precision industries.

An overview table for Europe’s market segmentation is presented below:

| Country | Market Share (2025) | Forecast Growth Areas |

|---|---|---|

| Germany | 32.5% | Industrial gas processing, healthcare diagnostics |

| United Kingdom | 24.0% | Medical imaging and industrial applications |

| France | 18.5% | Healthcare infrastructure expansion |

| Italy | 12.0% | Aerospace and defense applications |

| Spain | 8.0% | Industrial gas distribution enhancements |

This case study illustrates that while Europe faces some of the same challenges as other regions, such as supply concentration and complicated extraction procedures, there is also significant potential for growth driven by robust demand across multiple sectors.

Key Players and Competitive Landscape

The helium market is moderately concentrated, with approximately 15-20 notable players making up most of the market share. Industry giants such as Linde Plc, Air Products and Chemicals, Inc., and Air Liquide continue to lead due to their extensive global distribution networks and technical expertise in cryogenic systems.

Other important competitors include:

- Messer Group and Taiyo Nippon Sanso India, known for their strong regional presence.

- MESA Specialty Gases & Equipment and Matheson Tri-Gas Inc., which focus on offering specialized helium solutions.

- Regional and emerging companies that continue to invest in advanced helium extraction and recycling technologies.

Competitive dynamics in this market are less about price competition and more about supply reliability and the capacity to deliver high-purity helium consistently. As organizations invest in helium extraction technology development and integration with end-use applications, the market remains both competitive and resilient.

Opportunities for Innovation and Growth

Innovation remains at the heart of the helium market’s potential. As technological advancements continue to improve the efficiency of extraction and recovery processes, new opportunities arise that could help alleviate many of the current supply challenges. These opportunities include:

- Next-generation Recovery Systems: Development of recovery technologies that enhance capture efficiency and reduce production costs.

- Closed-loop Recovery Mechanisms: Incorporation of recovery systems into existing production lines to minimize helium wastage and support conservation initiatives.

- Digitally Enhanced Supply Chain Management: Use of advanced analytics and AI tools to figure a path through potential supply bottlenecks, ensuring timely and reliable deliveries.

- Joint Ventures and Collaborations: Strategic partnerships between helium producers and end-user industries can help manage the overwhelming supply chain challenges and foster research into new applications.

Such innovations not only address the current supply limitations but also pave the way for a more sustainable and resilient market structure.

Government and Industry: Working Through the Tangled Issues Together

Persistent industry challenges require not only commercial strategies but also collaborative policy interventions. Governments can simplify the tricky parts by offering targeted funding for R&D, streamlined regulatory processes, and tax incentives that encourage domestic production and conservation initiatives.

Key policy recommendations include:

- Strategic Reserve Initiatives: Investment in national helium reserve programs can ensure a stable supply during periods of market volatility.

- R&D Tax Credits and Subsidies: Providing financial support for companies aiming to improve extraction and recovery methods makes the process less overwhelming and more attractive.

- Clear Regulatory Guidelines: Establishing industry-wide quality standards and streamlined licensing procedures will help companies discover the best path through complicated regulatory landscapes.

- Skills Development Programs: Training initiatives for cryogenic technicians and gas processing experts ensure that the industry has the talent needed to support these advanced technologies.

Collaborative efforts between policymakers and key industry bodies will be crucial in reducing the confusing bits of regulatory uncertainty and ensuring that both large and small players can manage their helium supply effectively.

Future Projections and Market Sustainability

Looking ahead, the helium market appears set to continue its robust expansion over the next decade. However, sustaining this growth while managing the supply chain’s many twists and turns will be a nerve-racking challenge that requires industry-wide cooperation and a commitment to technological innovation.

Future scenarios indicate that:

- The medical imaging sector will remain a major driver as diagnostic infrastructure continues to spread globally.

- The semiconductor industry will demand consistently higher purity helium levels to support further product miniaturization and quality control.

- Aerospace and defense applications will drive adoption of specialized helium products, particularly in regions where space exploration and cutting-edge research are priorities.

- Advancements in helium recovery and recycling will be critical in reducing the overall demand stress on raw helium supplies.

These projections, while promising, underscore that every player in the market—from policymakers to industrial producers—must take a closer look at the fine points of managing a complex supply chain. Balancing growth with sustainability will be a super important goal that the industry must collectively work toward.

Conclusion: Charting a Clear Path for the Helium Market

In summary, the helium market is on an exciting growth path, characterized by expanding demand in medical imaging, semiconductor manufacturing, and aerospace applications. While the market’s projected growth from USD 4.4 billion to USD 8.5 billion by 2035 is a bright indicator of its potential, companies and government bodies alike must prepare to steer through a series of tricky parts and tangled issues related to supply security, extraction, and regulatory compliance.

Industry leaders continue to innovate by adopting advanced helium recovery systems that not only help mitigate supply risks but also promote cost-effectiveness and sustainability. At the same time, regional hubs such as the U.S., China, and Germany demonstrate that strategic investment in helium extraction and distribution technologies can maintain a competitive edge in this critical market segment.

Policymakers have a super important role to play by offering subsidies, streamlining regulatory processes, and investing in vocational training programs that ensure the development of a skilled workforce capable of managing the subtle details of cryogenic and gas processing technologies. Meanwhile, collaboration between industry bodies reinforces quality standards and pushes the envelope on technological advances that can help unlock new applications for helium in the future.

In a market that is both promising and full of problems, clear and coordinated efforts can help industry players find their way through the confusing bits of supply chain management, ensuring that helium remains a linchpin technology for critical global industries. As we look to 2035 and beyond, the key takeaway is that success in the helium market will depend on the ability to work through complicated pieces of technological innovation, regulatory frameworks, and supply chain logistics in a consistent and forward-thinking manner.

For companies operating in this space, the challenge is clear: invest in technology, work closely with government and industry partners, and continually adapt to the dynamic landscape of both demand and supply. With careful planning and strategic foresight, the helium market’s future is not only sustainable—it is poised for remarkable growth and increased significance in the broader industrial ecosystem.

As we navigate this period of rapid change, all stakeholders can benefit from a collaborative approach that acknowledges the nerve-racking nature of the current market scenario while embracing the exciting new possibilities on the horizon. Now more than ever, it is essential for producers, distributors, and end-users alike to dig into the fine points of helium technology and develop strategies that secure its future as a super important resource in the global economy.

Ultimately, the helium market’s story is one of dynamic change, promising outlook, and the continuous need to figure a path through an environment that is both challenging and full of opportunity. With the right mix of innovation, cooperation, and proactive policy measures, the coming decade could well be a transformative period for all those involved in harnessing the power of helium.

Originally Post From https://www.factmr.com/report/helium-market

Read more about this topic at

Helium Market Forecasts Report 2025-2030

Helium Market Size, Share & Trends | Industry Report, 2030